Warehouse and wholesale clubs occupy a unique position in the retail landscape. Originally developed as a no-frills alternative to traditional wholesale supply for small to mid-sized companies, this segment now represents 4.9% of total US retail sales, generating $626 billion in revenue in 2022 and growing at an annual rate of about 6% since 2007. What differentiates warehouse clubs from other retailers isn’t solely their financial performance but their membership-based business model, one that creates a subscription-like recurring revenue stream and a committed customer base that frequently interacts with the brand.

The membership model also creates opportunities for implementing sophisticated, feature-rich loyalty programs that extend beyond traditional offerings to include travel. Many warehouse club loyalty programs already offer some form of travel discounts and booking capabilities to members, but by expanding the types of reward options available and leveraging member data to create more personalized experiences, warehouse clubs can significantly boost engagement and attract new members. A robust portfolio of travel rewards (and lifestyle rewards that complement travel) can tap into the inspirational nature of travel, giving members access to something they dream about and creating stronger brand-customer relationships that drive loyalty.

Many warehouse clubs recognize this, according to a survey we conducted of US warehouse/wholesale club professionals and part of our broader analysis of membership organizations in the United States in The Benefits of Belonging: An Analysis of Membership-Based Organizations, Their Constituents, and Their Loyalty Strategies. Based on our polling, we know that membership growth and new member acquisition are the top priorities for warehouse clubs in 2024, and 32% are planning to invest in personalization capabilities over the next 6 to 12 months.

Other findings suggest there is room for improvement in warehouse clubs’ approach to both member benefits and driving member loyalty through travel offers and rewards; less than half of surveyed members (46%) say they have a great travel experience comparable with travel sites or online travel agencies, even though 93% of the warehouse and wholesale clubs we surveyed have some type of travel booking capability.

By analyzing the survey data, we can gain deeper insights into the current state of travel loyalty among warehouse clubs and pinpoint areas for enhancement. Here’s what we found:

The Domain of the Warehouse Club in the US

Warehouse clubs are a sizable segment of the American retail landscape, dominated by three big brands – Costco, Sam’s Club, and BJ’s Wholesale Club. They also represent an outsized portion of retail geographic area: the average square footage of a Costco, for example, is 146,000 ft^2. This partly explains why the largest groups of respondents in our survey were from California (13%), Texas (13%), and Florida (9%), states with ample real estate, car-centric infrastructure, and large populations. It also correlates to the percentage of consumers who said they interacted most frequently with warehouse clubs.

Goals and Challenges: How Warehouse Clubs are Addressing Growth and Revenue Needs

The primary business goals for warehouse clubs are membership growth and new member acquisition, as revenue is linked directly to member volume and spending. Yet additional goals emerge when assessing the specific objectives of warehouse clubs and what they want their loyalty programs to achieve.

For the biggest warehouse clubs – those with 1 million or more members – the top priorities for their loyalty programs are member retention (38%) and revenue growth (38%), followed by increasing engagement (12%) and reducing points liability (12%). Clubs with fewer than 1 million members prioritize building a more robust earning and redemption portfolio (23%) and revenue growth (16%).

This suggests that “smaller” warehouse clubs, for which membership growth is a comparatively more pressing concern, perceive a positive correlation between reward portfolio breadth and their ability to attract new members. These findings also reveal that while new member acquisition is a key business goal for the most prominent clubs, they primarily view their loyalty programs as mechanisms for member retention.

The Warehouse Club Approach to Loyalty

Warehouse clubs value their loyalty initiatives highly, and rightly so. Almost all—95%—of warehouse clubs in our survey say their loyalty programs help them achieve their top-ranked business goals.

This is why 93% of warehouse club loyalty programs offer travel booking capabilities, and 61% offer redeemable travel rewards. Of those rewards, car rental (46%), hotel/lodging (46%), and travel insurance (41%) are the most offered. The largest warehouse clubs are more likely to provide lifestyle rewards in addition to travel-specific rewards, including food delivery (50% vs 32%) and spa/wellness services (28% vs 13%).

But as those percentages indicate, there is room for warehouse clubs to increase the breadth of their rewards portfolios by offering additional lifestyle rewards. Some retailers already plan to: 44% intend to introduce rewards for gas purchases in the next 6-12 months, 31% plan to offer new rewards for dining and grocery shopping, and 28% for charitable giving.

These findings align with warehouse clubs' priorities, specifically growing their membership base and revenues through expanding the rewards and benefits offered. What, then, could be hindering them from achieving these goals?

The Technology Gap?

As robust as they are in terms of membership volume and travel booking capabilities, warehouse club loyalty programs are held back by technological limitations. In our survey, 46% of retail professionals said better technology would solve all or most of their loyalty-related challenges. Even among the largest warehouse clubs, which ostensibly have the most resources available, 38% say better technology would solve most of their problems.

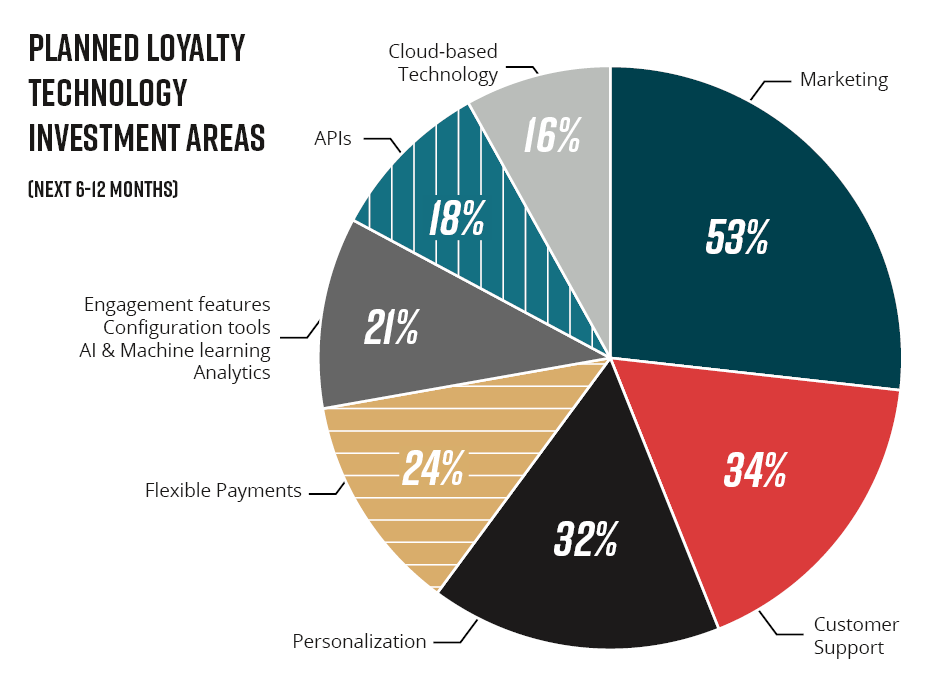

The good news is that warehouse clubs plan to invest in their loyalty program technology soon. These investments, however, lean toward creating better experiences for members, including planned investments in customer support (34%) and personalization (32%). The clubs that aren’t actively investing in new loyalty technology capabilities are hindered by a lack of available resources (29%) or not having identified a suitable technology partner (16%).

Engaging the Warehouse Club Member

Most (56%) US consumers in a warehouse club interact at least weekly. Unsurprisingly, the aspect of membership they value the most is access to discounts (60%), and they are aware of the benefits their club’s loyalty program offers them.

More than half (52%) of warehouse club members said they would engage even more if offered more reward and benefit options in general or additional status perks. Another 59% said they would book travel more frequently if their club offered higher-quality travel options. And 55% would like to receive personalized offers on bundled travel packages from their warehouse club travel loyalty program.

Warehouse clubs have an opportunity to encourage deeper engagement among their members by offering a broader selection of travel and lifestyle rewards. The fact that warehouse club members interact relatively frequently with the brand suggests that they will take advantage of the rewards and benefits presented to them, provided they are offered in a relevant, personalized way.

As evidenced by their investment plans, intent to expand their rewards portfolios, and prioritization of member-oriented technological improvements, warehouse clubs understand the value of their loyalty initiatives and their potential impact on financial performance. The barriers they face – specifically partnering with a loyalty technology provider that can deliver the capabilities they need cost-effectively – are relatively easy to overcome, provided they can identify the right partner. Once they do, however, the potential for warehouse club travel loyalty is poised to grow as fast as the segment itself.

Does your warehouse club offer a selection of travel and lifestyle rewards that keep members engaged and create an attractive incentive for new member acquisition? Find out how your loyalty strategy stacks up by downloading our report or get in touch with us today.

Want to get more insights and updates from iSeatz? Sign up for our newsletter!

You can also learn more about iSeatz by reaching out to marketing@iseatz.com.

.png?width=640&name=Untitled-12%20(4).png)